Our investment framework defines the key characteristics of our investment universe and our approach to asset allocation.

QIA allocates assets dynamically and flexibly. With this approach, we have established an excellent track record both for identifying long-term opportunities, and for making bold, intelligent investments.

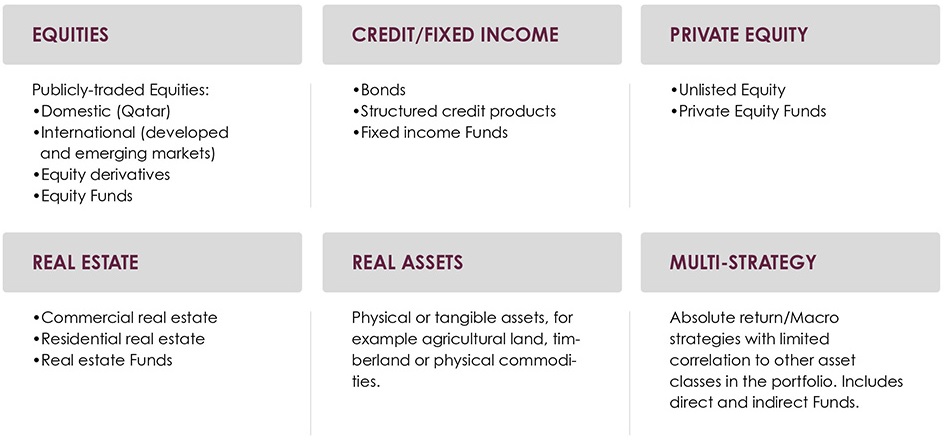

Our aim is to achieve sustainable risk-adjusted financial returns in the best interest of QIA. We therefore invest globally, directly or through Funds, in asset classes such as:

• Equities

• Credit and Fixed Income Securities

• Private Equity, such as off-market transactions in non-listed companies

• Real Estate

• Real Assets

• Multi-strategy

We employ derivatives as part of our investment strategy. We continually review our investment strategy, both to take into account ever-changing market conditions and developing trends, and also to identify and take advantage of new opportunities.

QIA Asset Classes (Examples):